Abstract

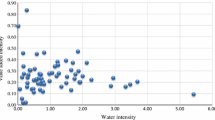

This paper examines the determinants of virtual water trade – embodied in agricultural products – and tests the relationship between property rights and the export of water-intensive products. Using two different measures of property rights protection, I show that countries with weaker property rights have an apparent comparative advantage in the export of water-intensive products. After controlling for economic size, natural resource endowments and bilateral trade determinants, the trade flow of virtual water is negatively and significantly correlated with the property rights index of the exporting country. The results are robust across different estimation methods.

Similar content being viewed by others

Change history

19 April 2018

Due to an oversight, Figure 2a was incorrectly captured in the original publication.

Notes

More recently, Copeland and Taylor (2009) further explain the relationship between trade and property rights in a dynamic model whereby the degree of property rights enforcement is endogenously determined by three forces: the regulator’s enforcement power, the extent of harvesting capacity, and the ability of the resource to generate competitive returns without being extinguished.

For example, Acemoglu and Johnson (2005) defines “property rights institutions” as institutions constraining government and elite expropriation, which are “intimately linked to the distribution of political power in society because they regulate the relationship between ordinary private citizens and the politicians or elites with access to political power”.

The correlation between the property rights index and per capita GDP of a country is 0.747; the correlation between the property rights index and the natural log of per capita GDP is 0.738.

The correlation between NRPI and per capita GDP of a country is 0.145; the correlation between NRPI and the natural log of per capita GDP is 0.162.

The database is developed by French research institute Centre d’Études Prospectives et d’Informations Internationales (CEPII), based on bilateral trade data provided by the United Nations Statistical Division. See Gaulier and Zignago (2010) for more details.

Values of foreign contents in the exports of agricultural products are relatively low. The OECD-WTO Trade in Value Added (TiVA) database indicates that share of foreign content of gross exports in 2005 for “Agriculture, hunting, forestry and fishing” industry is 13.79%, and for “Food products, beverages and tobacco” industry is 20.15%.

Although data are available for all years covered in the study, in some years the data might be missing for certain countries. Where necessary, I replace the missing data with observations of the country from the previous or subsequent year.

Clustering at the country-pair level allows the variance to differ across importer-exporter pair, permits an unstructured covariance within the clusters to control for correlation over time.

The summary statistics indicate that the dependent variable “bilateral virtual water trade” has more than 10% zero values.

References

Acemoglu D, Johnson S (2005) Unbundling Institutions. J Polit Econ 113:949–995

Allan JA (1998) Virtual water: A strategic resource global solutions to regional deficits. Groundwater 36:545–546

Allan JA (2003) Virtual water-the water, food, and trade nexus. Useful concept or misleading metaphor? Water Int 28:106–113

Anderson JE, van Wincoop E (2003) Gravity with gravitas: A solution to the border puzzle. Am Econ Rev 93(1):170–192

Antonelli M, Sartori M (2014) Unfolding the potential of the virtual water concept. What is still under debate?. IEFE, Center for Research on Energy and Environmental Economics and Policy, Universit Bocconi, Milano

Baier SL, Bergstrand JH (2009) Bonus vetus OLS: A simple method for approximating international trade-cost effects using the gravity equation. J Int Econ 77:77–85

Baldwin R, Taglioni D (2007) Trade effects of the euro: A comparison of estimators. Journal of Economic Integration 22:780–818

Center for International Earth Science Information Network, Columbia University (2014) Natural resource protection and child health indicators, 2014 Release. https://doi.org/10.7927/H46M34RP

Chichilnisky G (1994) North-south trade and the global environment. Am Econ Rev 84(4):851–874

Copeland BR, Taylor MS (2009) Trade, tragedy, and the commons. Am Econ Rev 99:725–49. https://doi.org/10.1257/aer.99.3.725

Debaere P (2014) The global economics of water: Is water a source of comparative advantage? American Economic Journal: Applied Economics 6:32–48

Fracasso A (2014) A gravity model of virtual water trade. Ecol Econ 108:215–228

Gaulier G, Zignago S (2010) BACI: International trade database at the product-level. The 1994-2007 version. Working Papers 2010-23, CEPII, http://www.cepii.fr/CEPII/en/publications/wp/abstract.asp?NoDoc=2726

Harris I, Jones P, Osborn T, Lister D (2014) Updated high-resolution grids of monthly climatic observations-the CRU TS3.10 dataset. Int J Climatol 34:623–642

Hoekstra A (2010) The relation between international trade and freshwater scarcity. WTO Staff Working Paper

Hoekstra AY, Chapagain AK (2007) Water footprints of nations: water use by people as a function of their consumption pattern. Water Resour Manag 21:35–48

Hoekstra AY, Hung PQ (2005) Globalisation of water resources: international virtual water flows in relation to crop trade. Glob Environ Chang 15:45–56

Kochhar MK, Pattillo MCA, Sun MY, Suphaphiphat MN, Swiston A, Tchaidze MR, Clements MBJ, Fabrizio MS, Flamini V, Redifer ML et al (2015) Is the Glass Half Empty Or Half Full?: Issues in Managing Water Challenges and Policy Instruments. International Monetary Fund

Kumar MD, Singh OP (2005) Virtual water in global food and water policy making: is there a need for rethinking? Water Resour Manag 19:759–789

Margat J, Frenken K, Faurès JM (2005) Key water resources statistics in AQUASTAT: FAO’s global information system on water and agriculture. Intersecretariat working group on environment statistics (IWG-Env), international work session on water statistics, Vienna

Mayer T, Zignago S (2011) Notes on CEPII’s distances measures: The GeoDist database. Working Papers 2011-25, CEPII, http://www.cepii.fr/CEPII/en/publications/wp/abstract.asp?NoDoc=3877

Mekonnen MM, Hoekstra AY (2011) The green, blue and grey water footprint of crops and derived crop products. Hydrol Earth Syst Sci 15:1577–1600

Mekonnen MM, Hoekstra AY (2012) A global assessment of the water footprint of farm animal products. Ecosystems 15:401–415

Mekonnen M, Hoekstra A, Becht R (2012) Mitigating the water footprint of export cut flowers from the Lake Naivasha Basin, Kenya. Water Resour Manag 26:3725–3742

Nunn N (2007) Relationship-specificity, incomplete contracts, and the pattern of trade. The Quarterly Journal of Economics 122(2):569–600

Romalis J (2004) Factor proportions and the structure of commodity trade. Am Econ Rev 94(1):67–97

Roson R, Sartori M (2010) Water scarcity and virtual water trade in the Mediterranean. University Ca’Foscari of Venice, Dept of Economics Research Paper Series (08-10)

Ruhl J, Salzman J (2007) The law and policy beginnings of ecosystem services. Journal of Land Use & Environmental Law 22(2):157–172

Silva JS, Tenreyro S (2006) The log of gravity. Rev Econ Stat 88:641–658

Stroup R, Baden J (1979) Property rights and natural resource management. Literature of Liberty ii:5-44, http://www.econlib.org/library/Essays/LtrLbrty/strbdPR1.html

World Economic Forum (2014) Global Competitiveness Index 2006-2014. Tech. rep. The Global Competitiveness Report, World Economic Forum, http://www.weforum.org/reports/global-competitiveness-report

Wichelns D (2004) The policy relevance of virtual water can be enhanced by considering comparative advantages. Agric Water Manag 66:49–63

Yang H, Reichert P, Abbaspour KC, Zehnder AJ (2003) A water resources thresh- old and its implications for food security. Environ Sci Technol 37:3048–3054

Acknowledgments

I would like to thank Professor Richard Baldwin, Professor Nicolas Berman, Professor Jaime de Melo, Professor Andrea Fracasso, Martina Bozzola, Derek Eaton, Lys Kulamadayil, Arun Jacob, Maria Matthew, Joëlle Noailly, David Trouba and Christos Zoumides for their helpful comments on earlier versions of the paper.

Author information

Authors and Affiliations

Corresponding author

Additional information

This paper represents the opinions of the author, and is the product of professional research. It is not meant to represent the position or opinions of the WTO or its Members, nor the official position of any staff members. Any errors are the fault of the authors.

The original version of this article was revised: Due to an oversight, Figure 2a was incorrectly captured in the original publication. The correct Figure 2a image is reloaded in this version.

Appendix

Appendix

1.1 Proof: Resource Supply and Property Rights

Suppose the supply of environmental resources is price-dependent, i.e. Es = Es(p E ), where p E is the price of the environmental resources. Assume that environmental resource E is extracted from a resource pool using an input x which has opportunity cost q. Under an unregulated common-property regime, the extraction of the input E is carried out by N farmers, indexed i = 1,...,N. Let x i be the input of harvester i, and let \(x={\sum }_{i = 1}^{N}{x_{i}}\).

The total harvest can be expressed as a function E = F(x) of the total input. I assume F(0) = 0, F′(x) > 0, and F(x) is strictly concave, so there are strictly diminishing returns. The concavity assumption is realistic in the case of exhaustible natural resources. The diminishing returns arise from the use of an increasing amount of input x to a fixed body of natural resources.

Assume also that all farmers are symmetric, so that each farmer obtains as its output a fraction of the total output equal to the fraction that it supplies of the total input, E i = F(x)(x i /x). Each farmer chooses its input level x i to maximize the value of its share of output net of costs, p E E i (x i ) − qx i , here p E is the market-induced price of the resources, and q is the “opportunity cost” of the input x i .

The private-property marginal product of the input is denoted MPP and the common-property marginal product is MPC. Denote \(x_{-i}={\sum }_{j\neq i} x_{j}\), the marginal product under common property rights regime is:

The marginal product of input is F′(x), the average product is F(x)/x. When N →∞, x i /x → 0, and the common-property marginal product becomes the average product.

Under private property rights regime, on the other hand, the individual marginal product of input equals the aggregated marginal product, hence \(M{P_{i}^{P}}=F^{\prime }(x)\). The difference between the common-property marginal product and the marginal product under private property regime would be:

The last inequality is derived from the strict concavity, whereby F(x)/x > F′(x). Therefore, the common-property marginal product is always lower than the private-property marginal product.

For each PE, the farmer’s objective is to find x i which optimizes p E E i (x i ) − qx i . For each fixed q, the solution to this problem, denoted x i (p E ,q), is an increasing function of p E : as the market price of E increases, the marginal productivity of x i which maximizes the objective function of the farmer must satisfy p E (∂E i /∂x i ) = q. For each p E and q, this maximization problem defines E i = E i (x i (p E ,q)).

Under common-property regimens, more is supplied at any given price.

Rights and permissions

About this article

Cite this article

Xu, A. Trade in Virtual Water: Do Property Rights Matter?. Water Resour Manage 32, 2585–2609 (2018). https://doi.org/10.1007/s11269-018-1941-5

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11269-018-1941-5